I started debt recycling in June 2023 and by December 2024, my net worth had grown by $450k in just 18 months—without sacrificing my financial security or lifestyle.

But it wasn’t always smooth sailing. I had to make some big decisions, challenge my views on debt, and structure my finances in a way that made sense for my long-term goals.

This is the story of how I went from almost wiping out my investments in the name of being a debt-free homeowner (because I view debt as the bad guy) to building wealth strategically.

My Story

Long story short, I met my ex-husband at 19 years old and we were married when I was 26. At 28, he asked for a divorce just after my birthday in March. Soon after, while we only communicated through our lawyers, I found out that he was cheating on me because we had to disclose all of our assets. His bank summary showed that the had opened a joint bank account and set up a family Trust with one of his employee (he ran his own company, so he was the Founder & CEO).

As if that wasn’t bad enough, within few months of asking for a divorce, he also had liquidated 7% of his stake at his company that I helped built, to buy her a $680k apartment in Korea. The disclosure also showed that they had signed a contract and paid a $60k deposit for a $1.4M townhouse in Melbourne days before he asked me for a divorce. His bank statements also told plenty of stories, such as spending $80k for a brand new Mercedes car and spent further tens of thousands to pay for his new girlfriend’s MBA at Melbourne Business School and giving her 50% payrise at this company, and burned $70k on a trip to Korea where she’s from. They also wasted no time to have a baby. Wild.

Losing the people I thought were family for the past 10 years was hard. His whole family stopped talking to me. He pressured me to move out of our home within a month of asking for a divorce so that he could move in with his new girlfriend in the middle of a COVID lockdown.

At the time, I was suicidal and my manager thought I could use a break. He kindly offered to send me to work on a slower-pace project in Perth for 3 weeks with my best friend from work. It was like taking a paid holiday with little work and all expenses paid, so I took the opportunity.

However, my ex kept messaging me asking me to move out. I hadn't had a rental history in years, and I was worried that I wouldn’t be able to secure a place. I couldn’t even inspect the apartments in person and couldn’t sign a lease as I was in Perth. But the silver lining was that not many people were inspecting apartments in Melbourne CBD during the toughest lockdowns in Australia, so managed to find an apartment in Melbourne the day after I came back from Perth and as I was the only applicant, I was accepted immediately. I packed all of my stuff and I moved out of our home within a week.

Still, the financial burden was heavy. I was paying rent and an astronomical amount for divorce lawyer at the same time. So life as I know it had completely changed. It was demoralising to say the least.

To top it off, my apartment almost burned down one night because my neighbours e-scooter caught fire in the middle of the night at 2 AM on a Tuesday. I woke up to thick black smoke and had to evacuate in my pyjamas. As I stood across the street watching flames pour out of my neighbours window—just next to my unit, separated by a thin joint wall—I remember thinking, "Well, you’ve already lost almost everything in the divorce, so there is not much to lose in the fire. You’ll be fine. It’s just furnitures and clothes. You’ll be ok. All of your money is in the bank. You’ll have enough to buy new furnitures at IKEA and maybe a new wardrobe. Its about time to invent the new you after the divorce. You’ll survive this." Funny how your brain thinks when it tries to self-soothe. I still laugh at this thought whenever I think back about this.

Anyway, that moment shifted something in me. After two years of renting and almost losing everything twice, I was ready to own my own home and feel secure again.

⚠️ Disclaimer ⚠️

This content is for educational purposes only and does not constitute financial advice. The examples provided are hypothetical and based on assumptions. Your financial situation and results may differ. Debt recycling involves risks, including market volatility and changes in interest rates. This content does not recommend or promote any specific financial product or service. Always consult with a licensed financial advisor, tax professional, or mortgage broker to ensure this strategy aligns with your personal circumstances.

The Crossroads: My Biggest Financial Decision After Divorce

After my divorce and asset split, I walked away with just 10% of the total joint assets I had built with my ex. A 10/90 split was hard to swallow, but in dollar terms, this worked out to about $900,000—enough for me to start over in a position that was better than most. And for that, I am grateful.

My $900,000 net worth included:

$635,000 cash settlement from being bought out of our home and from my unpaid labour over the years in supporting him build a company valued at $24Million (with his share being about $10Million. I didn’t know better then and had trusted everything to be in his name for the company share).

$235,000 in shares, which I had purchased with my own salary and savings over the years.

A $30,000 car

Furniture, jewellery, and other chattels.

I was emotionally exhausted but determined to rebuild. The first thing I did? Buy a home. I wanted stability, and I found a place I loved in an area that felt right. The price tag? $900,000—a little over my budget, but after everything I had been through, I knew I needed this. Coincidentally, this was almost the exact value of my cash, shares, and car combined.

That left me with two choices:

Option 1️⃣ Buy the house outright.

Use all my cash and sell my shares to buy the house in full.

Be debt-free but have zero investments left.

Option 2️⃣ Take out a mortgage and keep my investments.

Own a home while keeping my shares invested.

Pay interest on my mortgage while letting my investments grow.

At first, Option 1 seemed like the safer move. After all, being debt-free is supposed to be the dream, right?

The Problem with Option 1: Paying Off My Home in Full

Growing up, I was taught that debt was something to be avoided like the plague. My dad was too proud to work for my grandfather, so he always try to build his own company. The problem was that he is not wise with money, spending it faster than he could earn and would rack up a ton of debt. My uncle was no different - he would take debt just so that he can have the latest cars and buy his family branded things from bags, shoes, belt, you name it. So I learned from an early age to avoid debt at all cost (and I have no appreciation for branded stuff).

But as I learned more about investing, I realised that not all debt is bad.

The Reality of Option 1?

I could choose to buy the house all-cash, without a mortgage. After all, debt is bad and who doesn’t want to be debt-free? However, it would mean that I need to sell all of my shares and my car in order to have enough cash. The problems are:

❌ I’d own my home, but I’d have no income-generating assets. A personal home isn’t an investment—it’s an expense.

❌ I’d have to start my investments from zero, losing years of compounding growth.

❌ On average, it takes 6–7 years to build the first $100k in investments from scratch.

Owning a home outright is great, but without investments, I’d be asset-rich and cash-poor—which didn’t align with my financial goals. Or I could opt for a smaller house that I don’t like in a location that I don’t want to live in away from my friends, which is not ideal for my mental health.

The Problem with Option 2: Taking Out a Mortgage

I could keep my investments intact and just take out a bigger debt. Keeping my investments felt like the right choice, but it came with a catch: Taxes and Interest.

I knew that investing early and consistently was the key to long-term wealth building. I wanted to keep investing because:

✔️ I’m young, with decades ahead to invest.

✔️ I can handle market ups and downs because I can wait for the market to recover.

✔️ I have a high-paying job, so mortgage repayments weren’t a huge strain. Plus in my industry, it was easy to get another job.

✔️ By keeping my investments, I was growing my net worth in multiple ways—not just through home equity.

But… ❌ The dividends from my investments added to my taxable income, while I was still paying mortgage interest. That’s a lot of money going to the ATO and the Bank’s pocket! So that made me think about how I can reduce my taxes and reduce non-deductible interest.

That’s when I discovered debt recycling.

SECRET Option 3: Debt Recycling

I had no idea this was even an option until I hired a Financial Advisor. During a strategy session with my tax accountant and mortgage broker, we mapped out a plan on a whiteboard that completely changed how I saw debt.

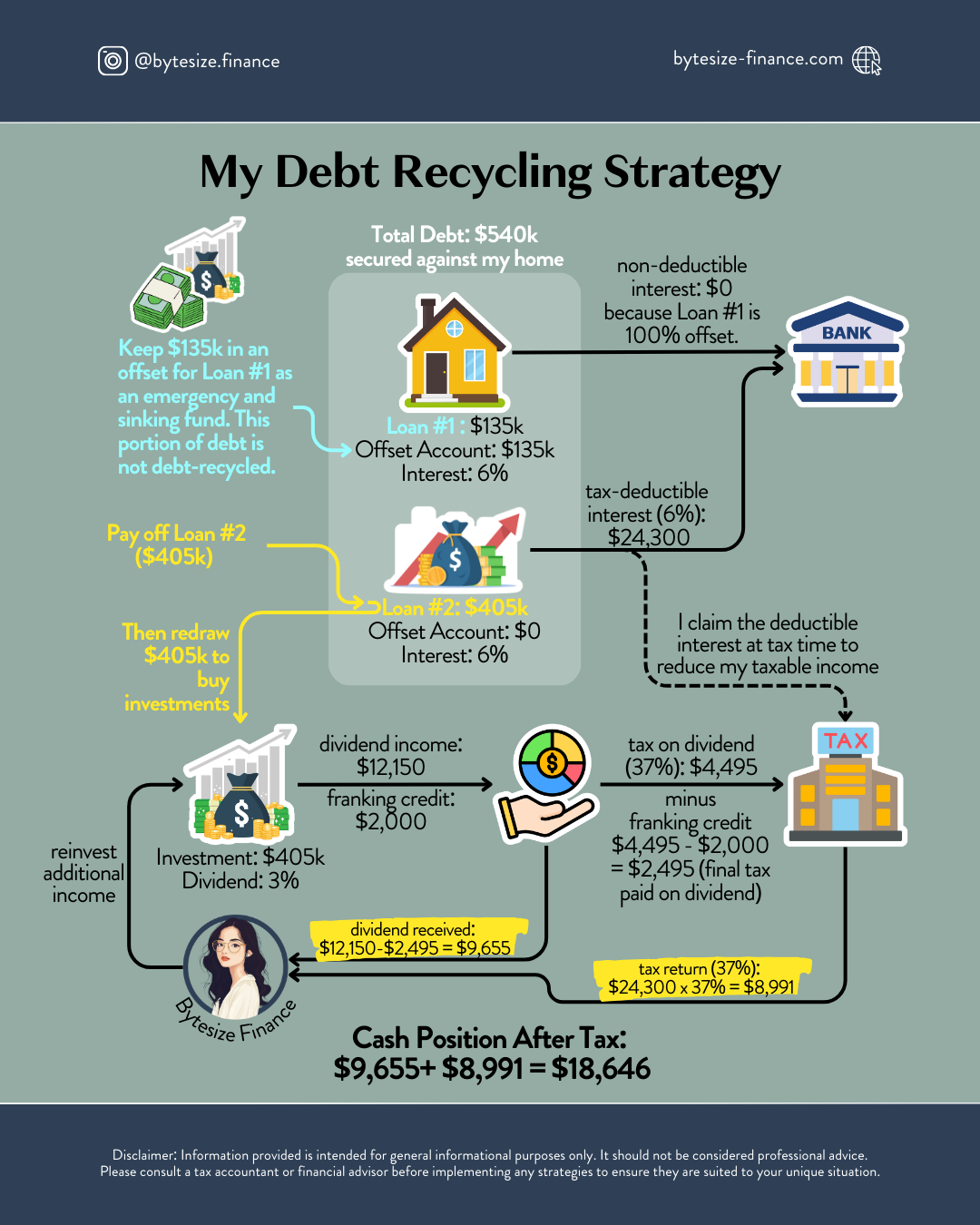

Here’s how I structured my $900k home purchase using debt recycling:

✔️ Took out a 60% loan ($540k) for a better mortgage rate.

✔️ Split it into two loans:

Loan #1 ($135k): Home loan with an offset. I wanted to keep at least $100k cash on hand for emergency, holidays, sinking funds and other future investment opportunities.

Loan #2 ($405k): For debt recycling. I chose this number because the monthly repayments would be around 30% of my salary at the time (before I was offered a new job with a higher salary). I also expected a couple more rate increases—and I was right. My rate eventually rose twice after settlement, reaching 6.29%.

✔️ Since all of the shares I held at the time were bought outright, I had to sell them to free up cash for debt recycling, my deposit, stamp duty, and closing costs.

After selling my shares, I had about $870k (excluding the car), which I distributed as follows:

Stamp Duty & Closing Costs: $50k (Ouch—this was an immediate $50k reduction in my net worth.)

House Deposit (40%): $360k (resulting in a 60% Loan-to-Value Ratio (LVR) to secure a better mortgage rate).

Paid Off Loan #2 ($405k), Redrew, and Invested in VDHG ETF.

Loan #2 became tax-deductible debt after this move.

I did this step in two stages:

Paid down $404,999, leaving $1 unpaid (some banks close the account immediately if a loan is paid off completely, so I left $1 unpaid to prevent this).

Redrew $404,999, bringing the total debt on Loan #2 back to $405,000. Keeping in mind the $1 unpaid earlier is still not debt-recycled. So now I needed to debt recycle the remaining $1 in the next step.

Paid the remaining $1, redrew the $1. Now I have the full $405,000 fund redrawn and transferred $405,000 to my investment account to buy VDHG ETF.

✔️ Kept $55k in my offset account against Loan #1 and aggressively saved $135k to fully offset Loan #1. Since Loan #1 was not debt-recycled, it remained as non-deductible home loan debt, and I wanted to minimise my interest costs.

The process looked something like this:

The Power of Debt Recycling

This strategy allowed me to claim tax deductions every year. While my dividends are currently less than my interest cost (meaning I am negatively geared), the growth of my shares remains unrealised gains. That means I am not paying tax on the gains until I sell—and when I do, as long as I’ve held them for more than 12 months, I qualify for the 50% Capital Gains Tax (CGT) discount.

Any tax return I receive goes straight back into my investment portfolio to accelerate compound interest. Since my investment growth far outpaces my interest cost, I am in no rush to pay off the debt-recycled loan quickly—this allows me to claim tax deductions for the next 30 years.

Total Net Worth Gain in 1.5 Years: Breaking Down the $450k Growth

My net worth grew from $900k to $1.35M in just 18 months (by December 2024)—all while owning my home and keeping my investments growing.

If I had purchased my home outright without debt recycling, my net worth would have only grown by $71k from home equity and salary savings. I would have started my investment portfolio from $0, missing out on substantial growth.

Final Thoughts

Why I Chose a Mortgage Instead of Paying in Full:

📌 The Growth Potential of My Investments: My shares had already grown significantly over time. If I sold them to buy a house outright, I would lose out on their future compounding returns. While mortgage rates fluctuate, historically, the stock market has delivered higher long-term returns than the cost of borrowing.

📌 Liquidity & Financial Flexibility: If I put every dollar into my home, I would be asset-rich but cash-poor. A paid-off house doesn’t pay bills, cover emergencies, or allow for other investment opportunities. Keeping my investments meant I still had a portfolio working for me.

📌 The Power of an Offset Account: Instead of dumping all my cash into the house, I put a significant portion into my offset account. This reduced my interest payments while still allowing me to access the funds if needed.

📌 Diversification of Wealth: Tying all my money into one asset—my home—felt risky. Keeping a diversified mix of shares + property meant I wasn’t putting all my eggs in one basket.

📌 Tax Strategy Considerations: While a mortgage on a primary residence isn’t tax-deductible, I knew that if I ever turned this property into an investment in the future, having a mortgage could be beneficial from a tax perspective.

So, What’s Next?

In the next chapter, I’ll cover the biggest mistakes people make with debt recycling—and how to avoid them!

💬 Got a question about debt recycling? Drop it in the comments—I might include it in the FAQ chapter at the end of this series.

With love,

Find me on Instagram.

📩 Subscribe to Bytesize Newsletter so you don’t miss out on the next Chapter!

📣 Sharing is caring. If you know someone who would benefit from this topic, please share this post.

⚠️ Disclaimer ⚠️

This content is for educational purposes only and does not constitute financial advice. The examples provided are hypothetical and based on assumptions. Your financial situation and results may differ. Debt recycling involves risks, including market volatility and changes in interest rates. This content does not recommend or promote any specific financial product or service. Always consult with a licensed financial advisor, tax professional, or mortgage broker to ensure this strategy aligns with your personal circumstances.