When I first started investing seriously after my divorce, I wanted something simple, diversified, and able to grow steadily without demanding my attention every day. Something that I could close my eyes to and leave in the market for 30+ years without needing to constantly rebalance my portfolio.

My Financial Advisor at the time recommended the VDHG ETF, and so that’s what I’ve been investing the majority of my portfolio in for the past two years.

However, as I started sharing my financial journey on Instagram, one question I always get asked during my Sunday "Ask Me Anything" sessions is: Which ETF is better between VDHG and DHHF?

I have been investing in VDHG — but that doesn't mean it's ‘better’ for everyone.

It depends on what kind of ride you want for your investment journey. The "right" ETF isn’t the one with the highest number today — it’s the one you can ride through both crashes and rallies for 20+ years while still sleeping peacefully at night.

Here's a side-by-side breakdown so you can choose your own adventure.

⚠️ Disclaimer ⚠️

This content is for educational purposes only and does not constitute financial advice. The examples provided are hypothetical and based on assumptions. Your financial situation and results may differ. This content does not recommend or promote any specific financial product or service. Always consult with a licensed financial advisor, tax professional, or mortgage broker to ensure this strategy aligns with your personal circumstances.

Overview: What Are VDHG and DHHF?

VDHG (Vanguard Diversified High Growth ETF) and DHHF (Betashares Diversified All Growth ETF) are "set-and-forget" investment options. Both aim for high growth over the long term by giving you exposure to thousands of shares around the world.

VDHG blends about 90% shares and 10% bonds, offering some safety cushion during market crashes. This mix can help smooth returns, particularly during downturns.

DHHF is 100% shares, no bonds at all, chasing maximum growth with no defensive protection. This means bigger ups but also bigger downs.

Important: There’s no "right" or "wrong". It’s about which ride suits your nerves, income needs, and long-term strategy.

Investment Strategy & Structure

Let's take a step back and compare the structure of each ETFs before we zoom into deeper metrics like fees and returns. Structure impacts how resilient your investment will be across different market conditions.

The primary distinction between these ETFs lies in their asset allocation:

VDHG: Blends growth and defensive assets, offering a smoother ride during market volatility.

DHHF: Focuses solely on growth assets, which can lead to higher returns but also greater fluctuations.

📈 Notes on Currency Hedging

When the Australian Dollar (AUD) moves, it affects the value of your international investments:

If the AUD falls:

Unhedged investments like DHHF benefit—your overseas assets become worth more in AUD.

Partially hedged investments like VDHG benefit less because the hedging cushions those movements.

If the AUD rises:

Unhedged investments like DHHF lose value.

VDHG suffers less impact.

Fees, Fund Size and Tax Structure

Fees seem small, but over decades they matter. Also, the fund structure can cause "tax drag" that quietly eats into your long-term returns.

Let's compare fees, fund size, and tax handling because these details affect not just performance numbers, but also how much you actually keep.

📜 Notes on Tax Drag

Tax drag is when taxes quietly slow down how much your investment grows.

Imagine investing in a fund that holds companies like Apple 🍏, Samsung 📱, and Toyota 🚗. Dividends are paid to the fund—but overseas governments take a cut first (withholding tax).

✅ If your fund is Aussie-domiciled (like VDHG), you can often claim back this tax. ❌ But if your fund invests through US ETFs (like DHHF), you lose part of that tax permanently.

Result:

With VDHG, you might keep $950 of every $1,000 dividend.

With DHHF, you might only keep $900.

Over decades, this small leak compounds significantly, especially on large portfolios.

🧾 Notes on Franking Credits

Even though VDHG allocates around 36% to Australian shares, and DHHF allocates a very similar 36.4% to Australian shares, the reason DHHF offers more franking credits is because:

In DHHF, almost all of the Australian allocation comes from A200, which is purely the top 200 Australian companies (high dividend payers like CBA, BHP, Woolworths — loaded with franked dividends).

In VDHG, the Australian exposure is split between:

Australian shares (franked dividends ✅),

Bonds (no franking ❌),

International shares (no franking ❌).

Because VDHG includes bonds and global shares, less of your income is franked even though the headline Australian allocation is similar.

Performance

Performance isn’t just about who has the bigger number today. It’s about risk-adjusted consistency and the path you need to emotionally endure to achieve those returns.

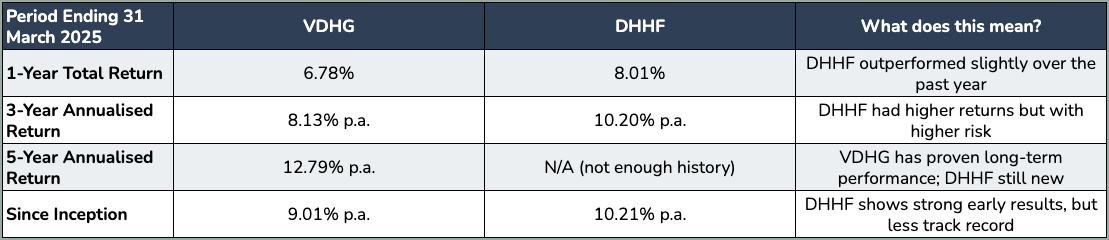

Let’s compare real returns, understanding they include dividend reinvestments (total return), and explain what that would have meant practically for an investor.

1.2% difference between 9.01% and 10.21% may not seem a lot. However, if $100,000 is invested over 30 years, it will look like this:

At 9.01% p.a. (VDHG), after 30 years: around $1,364,000.

At 10.21% p.a. (DHHF), after 30 years: around $1,849,000 ($485,000 more than VDHG)

✅ Takeaway:

Small return differences matter.

But higher returns often bring higher volatility.

Choose the ETF you can actually stick with during market crashes.

Income Distributions

For many investors, regular income matters. Whether you're building wealth or drawing passive income, the stability, size, and franking credits attached to distributions are worth noticing.

Let’s see how VDHG and DHHF stack up on dividend yield, franking credits, and payment reliability.

💰Income from $100,000 Investment

VDHG might generate around $4,400 p.a.

DHHF might generate around $2,400 p.a.

✅ VDHG = more regular cashflow. DHHF = more growth focus.

Risk and Investor Suitability

Risk is often misunderstood. It’s not just about whether an investment can go down (they all can) — it’s about how deeply it falls, how wildly it moves, and how your emotions can handle it.

Expected returns over the long term (based on the expected target return of 8% p.a. from both VDHG and DHHF PDS) may look similar for VDHG and DHHF, but the journey will be very different. Here’s a clear breakdown of the real swings you might face.

Risk isn’t just about investment losses—it's about emotional resilience.

DHHF (100% equities) = bigger swings.

VDHG (90% equities + 10% bonds) = smoother ride.

For example:

During COVID March 2020, global markets dropped around 35%.

A $100,000 DHHF investment could have temporarily dropped to $65,000.

A $100,000 VDHG investment might have dropped to around $70,000–$75,000.

If that $5k-$10k difference helps you avoid panic selling, then it is something to consider.

Summary

Final Thought: Choose the Ride You Can Stay On

Choosing between VDHG and DHHF isn’t about finding the "best" ETF.

It’s about matching your choice to your nerves, your cashflow needs, and your long-term goals.

Prefer steady income and a smoother ride? VDHG 🚂.

Chase maximum long-term growth and can handle the wild swings? DHHF 🎢.

The right ETF is the one you can hold for 30+ years without panic-selling.

Thanks for reading and being here 🧡

With love,

Find me on Instagram.

📩 Subscribe to Bytesize Newsletter so you don’t miss out!

📣 Sharing is caring. If you know someone who would benefit from this topic, please share this post.

⚠️ Disclaimer ⚠️

This content is for educational purposes only and does not constitute financial advice. The examples provided are hypothetical and based on assumptions. Your financial situation and results may differ. This content does not recommend or promote any specific financial product or service. Always consult with a licensed financial advisor, tax professional, or mortgage broker to ensure this strategy aligns with your personal circumstances.